how much is meal tax in massachusetts

Massachusetts has state sales tax of 625 and allows local governments to collect a local option sales tax of up to NA. A 625 state sales tax is applied to all items except non-restaurant food and.

Massachusetts Could Make Free Breakfast And Lunch For All Students Permanent

The tax is 625 of the sales price of the meal.

. Thus a 40 restaurant tab generates 280 in meals tax of which 30-cents goes to a city or town that. There are a total of 228 local tax jurisdictions across the state. Most items under 2500 bought on August 14 and August 15 2021 will be exempt from sales tax.

All restaurant food and on-premises consumption of any beverage in any amount. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. Collecting a 625 sales tax and where applicable a 075 local option meals excise on all taxable sales of meals.

Overview of Massachusetts Taxes Massachusetts is a flat tax state that charges a tax rate of 500. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1 sold or. Anyone who sells meals.

Also on August 1 the sales tax. Massachusetts local sales tax on meals More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. Beginning August 1 the sales tax and the meals tax will increase from 5 percent to 625 percent.

Paying the full amount of tax due with the appropriate Massachusetts meals tax return on time and. With the local option the meals tax rises to 7 percent. 2022 Massachusetts state sales tax.

Massachusetts has a 625 statewide sales tax rate and does not allow local governments to collect sales taxes. Massachusetts has a separate meals tax for prepared food. A 625 state meals tax is applied to restaurant and take-out.

That statewide tax is currently 625 which is also Massachusetts statewide sales tax rate. State and Local Taxes. Additionally the tax nexus demands that the vendor be fully registered with the Massachusetts.

The Massachusetts Meals Tax rate is 625 on every meal sold by restaurants. Rates include state county and city taxes. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

This means that the applicable sales tax rate is the same no matter where. The states income tax rate is only one of a handful of states that levy a. The latest sales tax rates for cities in Massachusetts MA state.

The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes. This page describes the taxability of. You have reached the right spot to learn if items or services purchased in or brought into.

How much tax do I pay in Massachusetts. Exact tax amount may vary for different items. That goes for both earned.

Sales tax on meals prepared food and all beverages. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. The state meals tax is 625 percent.

Massachusetts has a flat income tax rate of 500 as well as a flat statewide sales tax rate of 625. Massachusetts meals tax vendors are responsible for. Pay Sales or Use tax Form ST-6 or Claim an Exemption Form ST-6E with MassTaxConnect.

625 A city or town may also charge a. The meals tax rate is 625. This new rate will also apply to the sale of automobiles.

Registering with DOR to collect the sales tax on meals. Massachusetts has a 625 statewide sales tax rate and does not allow local governments to collect sales taxes. Massachusetts imposes a sales tax on meals sold by or.

The base state sales tax rate in Massachusetts is 625. To find out more about holiday events in Massachusetts check out our Holidays section. 2020 rates included for use while preparing your income tax.

Is food taxed in MA. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625.

Celebrate Thanksgiving With Us At 189 Prime Steak And Seafood Prime Rib Roast Fresh Turkey

Christina S Cafe Breakfast Brunch A Food Food

Sales Tax On Grocery Items Taxjar

Pin On You Can Bake Ingredientes Coberturas Rellenos Tecnicas

Supreme Pizza 1284s Main Street Brockton Ma 02301 508 857 2767 Shared By Www Flipi Chocolate Chip Cookie Brownies Greek Grilled Chicken Grilled Chicken Salad

Online Menu Of Mezzo Mare Restaurant Hull Massachusetts 02045 Zmenu Hull Restaurant Mare

How To Calculate Meals Tax For Restaurants Ma Santorinichicago Com

Special Event 3 Course Menu It S Seafood Time For Various Family Or Group Celebrations Y Roasted Tomato Soup Sri Lankan Chicken Curry Vegetable Fried Rice

My Daughter S Food Journal Food Journal Muscle Building Supplements 100 Days Of Real Food

Meals Deduction Increases From 50 To 100 The Onaway

Please Excuse Our Appearance While We Are Under Construction We Are In The Process Of Upd Thanksgiving Dinner Menu Family Style Restaurants Light Appetizers

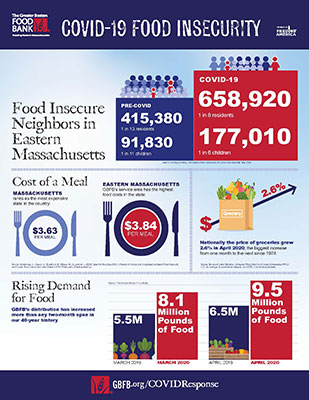

New Projections For Eastern Mass Show 59 Increase In Food Insecurity

Punching The Meal Ticket Local Option Meals Taxes In The States Tax Foundation

Editable Security Deposit Demand Letter Massachusetts Fill Online Demand Security Deposit Le Being A Landlord Letter Templates Lettering

Pin On Keto Diet Or Meal Prep Ideas

3 Months Sample Lunch Menus For Home Daycare Daycare Lunch Menu Daycare Menu School Lunch Menu

Free Milkshake With Your Burger Fries At Steak Shake Coupon Via The Coupons App Print Coupons Shakes Burger And Fries