how long does the irs have to collect back payroll taxes

Call the IRS or a tax professional can use a dedicated hotline to confirm that you only have to go back six years back for unfiled taxes. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection.

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

There is an IRS statute of limitations on collecting taxes.

. That collection period is normally 10 years. We work with you and the IRS to settle issues. If you are unable to pay at this time 3 How long we have to collect taxes 3 How to appeal an IRS decision4.

Form 433-B Collection Information Statement for Businesses PDF. Ad Owe back tax 10K-200K. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

If you file early lets say January 31 2020 the IRS has until April 15 2030 to collect. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. If you file your return 2019 return late say Jan 1 2022 then the IRS has until JAN 1.

For the ten weeks A is required to be paid at least 16hour for the full 400 hours. Under Federal law there is a time restriction on how long the IRS has to collect unpaid taxes. This is the length of time it has to pursue any tax payments that have not been.

The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment. Under IRC 6502a1 once the IRS has assessed the tax it has 10 years to collect it from the date of assessment. Need help with Back Taxes.

This is a long time when you consider that the IRS only has 10 years to collect its tax debts. As a general rule there is a ten year statute of limitations on IRS collections. Understanding collection actions 4 Collection actions in.

A tax assessment determines how much you owe. This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date. Ad The IRS contacting you can be stressful.

See if you Qualify for IRS Fresh Start Request Online. Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals PDF. Up to 25 cash back As a general rule there is a ten year statute of limitations on IRS collections.

Some of these taxes are almost 20 years old. Back in 2005 the California legislature enacted for. Theoretically back taxes fall off after 10 years.

Once taxes are assessed whether on your tax return or by the IRS in a notice theres a different time limit on IRS collections. How long does it take IRS to collect payment once taxes have been filed online and accepted. Owe IRS 10K-110K Back Taxes Check Eligibility.

Fortress Tax Relief Tax Relief Services. There are several options here so we will be looking at the best path forward for you. This time restriction is most commonly known as the statute of limitations.

Once you file a tax return the IRS only has a decade to collect your tax liability by levying your wages and bank account or filing a. How Long Does the IRS Have to Collect Taxes. Need help with Back Taxes.

The direct debit will occur on or after the date you specified when you selected the. This 10-year limit is. Technically except in cases of fraud or a back tax return the IRS has three years from the date you filed your return or April.

The IRS started accepting 2021 tax returns on Jan. Note that the statute of limitations on collections used. If you dont pay on time.

How far back can the. You Wont Get Old Refunds. Start with a free consultation.

In general the IRS has 10 years after the date of assessment to collect on delinquent taxes and tax-related fees although there are a few exceptions. Ad Get free competing quotes from leading IRS back tax experts. Dont Face the IRS Alone.

Start with a free consultation. First the legal answer is in the tax law. The IRS has a set collection period of 10 years.

If you did not file. How Long Does the IRS Have to Collect on a Balance Due. After this 10-year period or statute of limitations has expired the IRS can no.

The IRS has not yet released its 2022 refund schedule but you can use the chart below to estimate when you may. If you owe the IRS back taxes you may be wondering if the IRS forgives tax debt. Get A Free IRS Back Tax Resolution Consultation.

This means that the IRS can attempt to collect your unpaid taxes for up to ten. Ad The IRS contacting you can be stressful. We work with you and the IRS to settle issues.

This is pay of 128day which does not exceed the limit of 200day and total compensation.

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

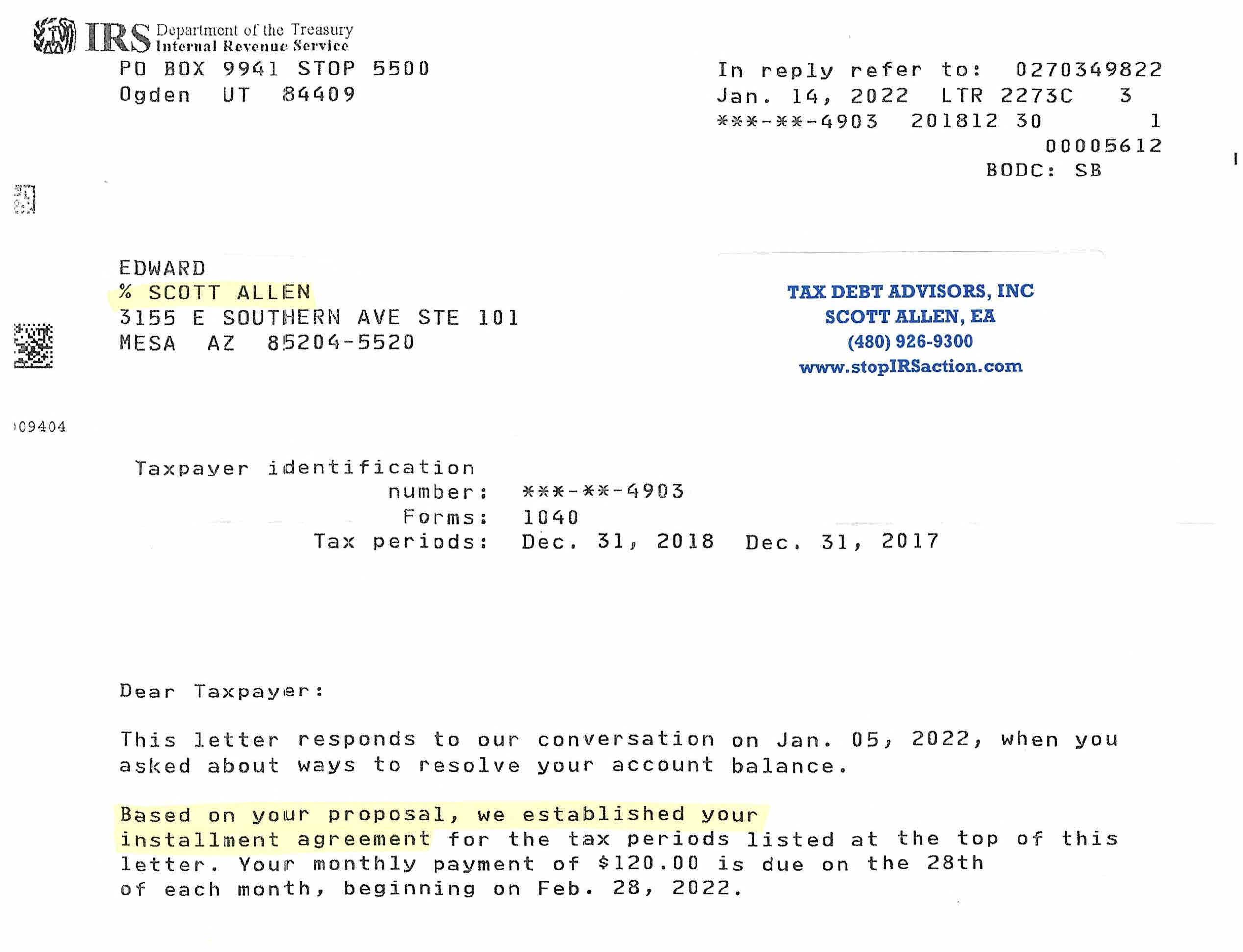

Irs Tax Payment Plan Tax Debt Advisors

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016

Houston Tx Irs Tax Resolution Services Simple Term Tax Center Inc

Guide To Irs Tax Penalties How To Avoid Or Reduce Them Turbotax Tax Tips Videos

Irs Tax Refunds What Is Irs Treas 310 Marca

Are There Statute Of Limitations For Irs Collections Brotman Law

How Long Can The Irs Try To Collect A Debt

Irs Tax Letters Explained Landmark Tax Group

Irs One Time Forgiveness Program Everything You Need To Know

How Do I Get My Irs Tax Debt Forgiven Fortress Tax Relief

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

Tax Consolidation Irs Debt Relief Help From Licensed Professionals

Irs Tax Problem Help Tax Lawyer In Nassau County Ny

Offer In Compromise Acceptance Letter Offer In Compromise Debt Relief Programs Tax Debt

What Does The Irs Do And How Can It Be Improved Tax Policy Center